Investor anxiety ahead of the US non-farm payrolls report, which is anticipated later today, is partially responsible for the market instability of today.

The key Indian indices, the Sensex and Nifty, had a significant decline on Friday due to investors’ anticipation of a critical US employment report that may impact the Federal Reserve’s interest rate policies. There were decreases in several key industries, including PSU Bank, Oil & Gas, Auto, and Consumer Durables. The reactions of global markets were likewise varied, and oil prices remained unchanged.

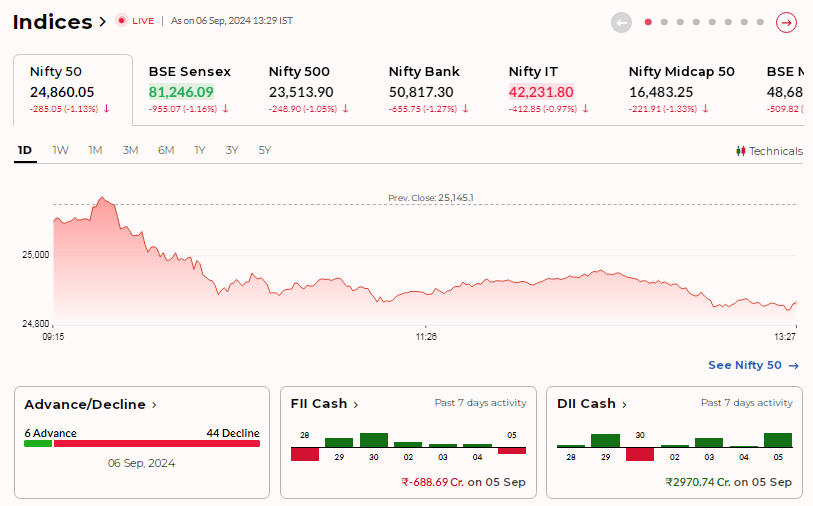

Red Alert! D-Street investors lose more than Rs 4 lakh crore when the Nifty falls below 24,900, Bank Nifty falls below 50900 and the Sensex falls more than 1,000 points.

Stock Market Crash Report

On September 6, the Nifty IT index gained 0.8 percent, while energy and banking stocks saw selling pressure in early trade. The Sensex and Nifty opened marginally lower but fell sharply thereafter ahead of a critical US jobs report that could determine the size and speed of the Federal Reserve’s interest rate cuts later this month.

At 1:30 PM, the Sensex was down 942 points or 1.13 percent at 81,287. Nifty fell below its crucial support of 25,000 and was down 253 points or 1 percent at 24,892.

In Shorts:-

- Sensex plunges 1000 points; Nifty & Bank Nifty drops over 1%.

- Nifty sees max action at 25000 Put with Volume 8.61 million and 26000 call with volume 6.64 million.

- HPCL, BPCL shares fall on reports of govt considering a fuel price cut.

- SBI stock falls nearly 4% to 3-month low over bearish call by Goldman Sachs.

- Bharat forge in focus, North America Class 8 truck orders below expectations.

- Nuvama turns bullish on Titan, raises target price to Rs 4,710.

165,000 more jobs will be created, according to analysts, and the unemployment rate will fall to 4.2%. But worries about fewer job opportunities and the possibility of a Federal Reserve rate drop have increased market ambiguity.

“The Fed might cut rates by 50 basis points if the August jobs data falls short of expectations and unemployment rises,” said Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services. This may cause additional market anxiety, particularly in light of possible slowdown worries.

Technical Analysis

Meena emphasized that the Sensex is presently challenging a critical support level at 24,850 from a technical perspective.

Should the index drop below this level, it may lead to more drops below 24,500 and 24,000. On the other hand, important resistance levels are at 25,150, 25,330, and 25,500 if the markets rebound.

Sector Wise Impact

Every sector was impacted by the general market slump. Reliance Industries, SBI, ICICI Bank, and Infosys were a few of the major firms that contributed most to the decline.

A number of sector-specific indices experienced declines of more than 2%, including Nifty PSU Bank and Oil & Gas, and more than 1% in Auto, Media, and Metal. Additionally, there were losses in small- and mid-cap stocks, falling by 0.9% and 1.3%, respectively.

Global Outlook

While Japan’s Nikkei suffered a small decline, the MSCI Asia-Pacific index saw a minor rise of 0.2% globally. US futures displayed decreases as well. Foreign institutional investors (FIIs) sold ₹688 crore worth of stocks in the domestic market, while domestic institutional investors (DIIs) purchased equities valued at ₹2,970 crore.

With Brent crude at $72.7 and US West Texas Intermediate at $69.16, oil prices stayed stable. With respect to the US dollar, the Indian rupee increased little, trading at ₹83.9350.